What is the physical market of a commodity exchange?

One of the most important markets of the commodity exchange is its physical market . The nature of this market is similar to the traditional market in terms of delivery of goods; Of course, with the difference that it has its own specific rules and mechanisms. The nature of the commodity market is such that producers of raw materials such as petrochemicals, metals, and agricultural products, so-called suppliers in the physical commodity exchange market, offer their products in the physical commodity exchange market. Consumers of raw materials, who are so-called producers, also buy these raw materials through a special market mechanism.

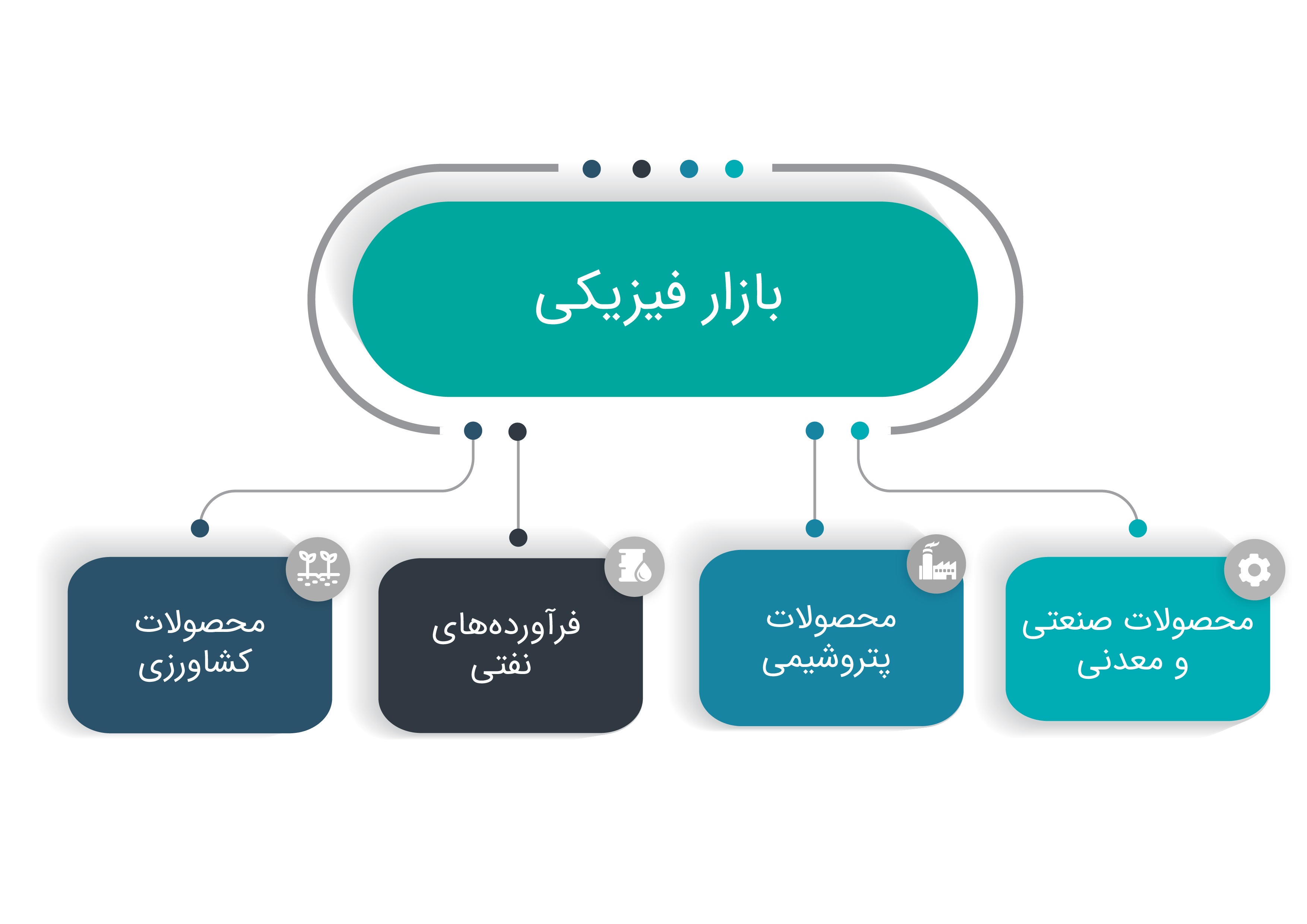

The difference between the physical market and the traditional market is in the laws that govern it and the mechanism of its purchase and its transparent prices. According to the classification made so far, the commodity groups traded so far include the following:

How to enter the physical market of the commodity exchange

A) How to enter the physical market of the Commodity Exchange for suppliers:

To enter the commodity exchange, suppliers need to accept their product in the commodity exchange. In order to accept the goods in the physical market or the so-called main market, it is necessary for the suppliers to complete the required documents of the commodity exchange. A committee called the Admissions Committee will then decide on this request. It should be noted that the admission board will announce its written opinion to the applicant through the exchange within 30 days after receiving the report and relevant documents from the exchange, stating the reasons for confirming or rejecting the acceptance of the goods.

B) How to enter the physical market of the commodity exchange for buyers:

To define buyers in the physical market of a commodity exchange, one must pay attention to the market conditions of that commodity. In the physical stock market, suppliers define buying conditions for buyers. Due to the increase in demand for goods offered in the physical market of the Commodity Exchange and also due to the pathology performed by the Commodity Exchange and the Industry and Mining Organization, in 99% of cases, producers (final consumers) buy goods from the Commodity Exchange.

In the physical market of commodity exchanges, buyers are divided into two categories of foreign and domestic buyers.

Before dealing with these two categories, according to the new rules by the management of brokerage supervision, it is necessary for all new customers who intend to get a transaction code to buy from the physical market of the Commodity Exchange to register in the Sajam system; Then proceed to code.

Customers are divided into two categories: real and legal customers:

Real customers:

To receive the transaction code of real customers, it is necessary for the customer to perform the following steps after registering in the SJAM system:

1- Written request to the broker to get the code

2- Completion of the coding form of real customers of the physical market of the Commodity Exchange

3- Completion of the profile form of the real customers of the physical market of the Commodity Exchange

4- Registration in the site of assets and tax affairs and sending the tracking code to the broker

5- Copy Identity card and national card

6- Sending the exploitation license if the exploitation license is in the name of a natural person.

Legal clients

In order to receive the transaction code of legal clients, it is necessary for the client to first register in the SJAM system. Then, in order to complete the registration, perform the following steps:

1- Written request to the brokerage to get the code

2- Completing the coding form of the legal clients of the physical market of the Commodity Exchange

3- Completing the profile of the legal clients of the physical market of the Commodity Exchange

4- Submitting the documents related to the company including: Articles of Association, Official Gazette Official Gazette of the members of the board of directors and holders of the company's authorized signature, birth certificates and national ID card authorized signatories, chairman of the board and CEO

5- latest audited financial statements together with the auditor's report and the Ombudsman law solely to establish whether legal persons

6. exploitation license If it is a production unit

7- Registration in the warehouse system

Coding for outsiders:

Foreign real persons:

1- Written request to the broker

2- Completing the coding form of the real customers of the physical market of the Commodity Exchange

3- Completing the form of the details of the real customers of the physical market of the Commodity Exchange

4- Valid passport of the respective country

Foreign legal entities:

1- Written request to the brokerage to get the code

2- Completing the coding form of the legal clients of the physical market of the Commodity Exchange

3- Completing the profile form of the legal clients of the physical market of the Commodity Exchange

4- Submitting the registration or establishment documents of the company are: establishment certificate or similar document, articles of association Or similar document, specifications and the limits of authority of the authorized signatories of the legal entity, documents related to the license to operate in the respective country that have been approved by the Iranian consulate.

5- Positive financial documents (audited property statements or similar documents) at the discretion of the stock exchange

What commodities are offered in the physical market of the commodity exchange?

The following table tries to provide a summary of the types of commodities that are offered in different markets of the physical commodity exchange:

| Physical market | Industrial and mineral products | Steel, copper, aluminum, iron ore, zinc, precious metal concentrates, molybdenum concentrates, sponge iron and… |

| Crops | Barley, corn, wheat, sugar, crude oil, meal (soy, rapeseed, sunflower, etc.), frozen chicken, saffron, rice, pistachios, lentils, eggs, chicken, etc. | |

| petrochemical products | Chemicals: Caustic soda, styrene, urea, benzene, diethylhexanol, orthosylene, monoethyl glycol, acetic acid and… | |

Polymer: polypropylene, heavy polyethylene, polyunyl chloride, polyethylene terephthalate, light polyethylene, polystyrene and… | ||

| Petroleum products | Oil, Bitumen, Vacuum Baton, Sulfur, Lubcate, Slapsovax, Waterproofing |

Buy from the physical market of the Commodity Exchange

The steps that a customer must go through to make a purchase from the physical market of the Commodity Exchange include:

1- Getting the code from the selected broker

2- Introducing a proxy account to buy and deposit 10% of the contract value to the proxy account until the specified time on the day of the transaction

3- Sending the purchase order to the broker and signing the purchase order and sending it to your broker before Transaction

In case of buying from the stock exchange (which we will explain the buying operation in a separate article), the following steps must be followed until the delivery of the goods:

1- Purchase settlement: After the purchase, 10% of the contract value will be deducted from the customer's account and the remaining 90% will be announced to the buyer during a purchase announcement and must be credited to the Commodity Exchange account by the time specified in the purchase announcement.

2- Sending the buyer's registration to the seller's broker: After the settlement, the buyer's broker announces the buyer's shipping letter to the seller's broker and sends it to the seller's broker along with the documents required for review and remittance.

3- Remittance: The seller's broker checks the registration sent by the buyer's broker along with the submitted documents and sends it to the seller after confirmation. After the necessary checks, the seller announces the remittance number to his broker (seller's broker) and through the buyer's broker, this remittance number is announced to the customer and the customer loads the purchased goods.

Last word:

In this article, we read about the types of goods traded in the physical market of the Commodity Exchange. Customers of the physical market of the commodity exchange are divided into two categories: domestic and foreign. Each of these groups has a different way of obtaining the Commodity Exchange trading code. After receiving the transaction code, buyers and sellers trade the desired product and goods by sending an order to their brokerage.

Learn more and read:

برای خرید تقره آنلاین به سایت کافه سیلور مراجعه کنید.